SLB announced an agreement to acquire ChampionX in an all-stock

transaction valued at $7.8 billion on April 2.1 Olivier Le Peuch, SLB’s

CEO, explained the merger’s rationale as follows:2

Our customers are seeking to maximize their assets while improving

efficiency in the production and reservoir recovery phase of their

operations. This presents a significant opportunity for service

providers who can partner with customers throughout the entire

production lifecycle, offering integrated solutions and delivering

differentiated value. The combination of ChampionX’s strong

production-focused leadership throughout North America and

beyond with our own international presence, unmatched technology

portfolio, and history of innovation will drive tremendous value for

our customers and stakeholders. Our core strategy remains centered

on meeting growing energy demand while accelerating decarbonization

and emissions reduction through innovation, scale, and

digitalization in our core oil and gas business. This acquisition will

expand SLB’s presence in the less cyclical and growing production

and recovery space that is closely aligned with our returns-focused,

capital-light strategy.

Becoming part of SLB will give us a much broader portfolio and the

resources and reach to continue to lead the industry in providing

energy to the world in an economically and environmentally sustainable

way. Our companies share a vision for the future of energy that

leverages technology and innovation to solve our customers’ most

complex problems and better serve the communities in which we

operate. For our shareholders, the combination provides compelling

value creation and the opportunity to share in significant upside from

the realization of synergies, including accelerated growth opportunities

given the complementary nature of the respective portfolios.

Executives believe mergers increase shareholder returns and customer

value through multiple avenues: access to new markets, broadened

and diversified business portfolios, new technology, rapid innovation,

expanded scale, increased resources, insulation from industry cyclicality,

and new lines of products and services.

Presumably, pursuing the avenues enables the merged companies

to simultaneously increase customer value and shareholder returns.

However, such dual growth can be difficult—as history and research

show. To ensure success, executives at both firms must consider at least

three critical factors: regulatory issues, M&A value dynamics, and the

best way to implement a strategy focused on customer value.

On July 2, the U.S. Department of Justice issued its second request

for information from SLB, potentially delaying the transaction’s

completion.4 SLB said at the time that it expects to address the requests

and complete its merger with ChampionX in 2025.

Though every M&A transaction is unique, the intended Halliburton–

Baker Hughes merger provides a cautionary tale. In 2016, the companies

abandoned a proposed $34 billion deal after DOJ sued to block

the transaction.5

In its response to the companies’ decision to vacate the deal, the justice

department offered a rationale at complete variance with the assessment

of the Halliburton and Baker Hughes CEOs. Attorney General

Loretta Lynch stated:

The companies’ decision to abandon this transaction—which would

have left many oilfield service markets in the hands of a duopoly—is

a victory for the U.S. economy and for all Americans. This case serves

as a stark reminder that no merger is too big or too complex to be

challenged…when companies propose deals that would enhance

shareholder value at the expense of consumer interests.6

Deputy Assistant Attorney General David Gelfand of the DOJ Antitrust

Division issued another statement:

Very few things are as

important to our economy

as oil and gas. But the

merger of Halliburton and

Baker Hughes would have

raised prices, decreased

output, and lessened

innovation in at least 23

oilfield products and

services critical to the

nation’s energy supply.

We achieved the only

result that could adequately

protect American

consumers—an

abandonment of this

unlawful merger.7

Companies base almost every M&A transaction on the premise that it

will increase shareholder value and customer value. Company leaders

invariably commit to wresting efficiencies and synergies to enhance

shareholder value. But what is the reality of M&As like the deal between

SLB and ChampionX?

A 2022 landmark study published in the prestigious Journal of Marketing

examined M&A’s effect on customer and shareholder value and its

underlying mechanism.8 The authors gathered data from 141 firms from

1995 to 2017, yielding 1,395 data points.

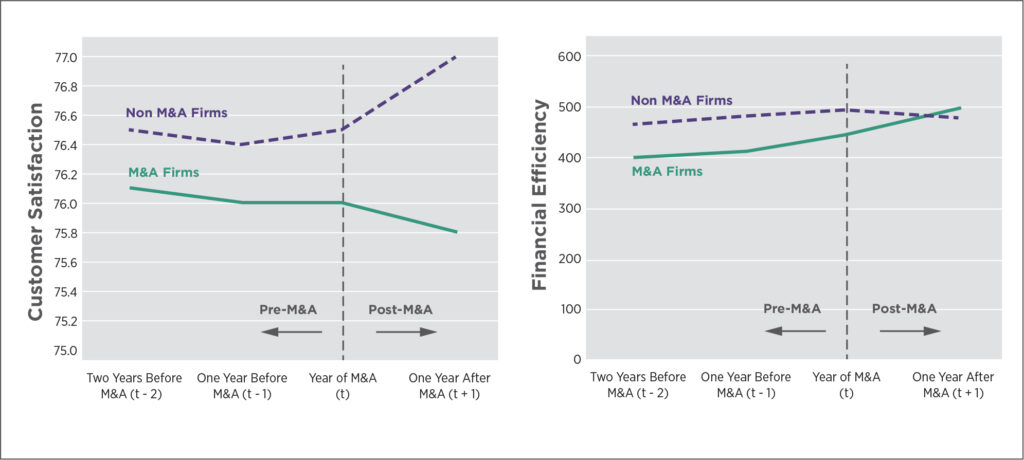

The study compared firms undergoing an M&A (M&A-firms) to themselves

before and after the transaction, as well as to a control group of

companies undergoing no such change (non-M&A firms). The study’s

sample and econometric methodology enable unambiguous and statistically

valid conclusions.9 Its main results are shown in Figure 1.

The most important takeaways from the results are as follows.

• After an M&A, customer satisfaction unambiguously declines among

M&A-firms relative to (1) the pre-M&A period and (2) compared to

non-M&A firms.

• In the post-M&A period, firm efficiency increases among M&A-firms.

• The gains from increased efficiency are outpaced by the losses from

decreased customer satisfaction.

• The net effect on firm value is negative for M&A-firms.

• M&-firms’ market value was $481 million less on average than that of

non-M&A firms one year after the transaction.

• The decline in market value occurs because executives’ attention at

M&A-firms becomes increasingly focused on financial issues at the

expense of customer issues. That is, executives become internally

focused on efficiencies instead of customer focused; this decreases

customer value and sales and leads to a decline in enterprise value.

M&A-firms’ executives become more focused on financial/

efficiency issues, which detracts from customer value. The resulting

decline in customer value lowers M&A firms’ value by an average

of $481 million in the post-transaction period.

Unless M&A-firms’ senior executives are intentional about customer

value, they are unlikely to create shareholder value after the transaction.

Intentionality requires measuring customer value, understanding

the strategic areas driving it, and ensuring that customer value is the

primary driver of the M&A integration process.

To remain focused on customer value, SLB and ChampionX must fully

understand customer value. Doing so requires both firms to have a valid

and reliable measure of customer value, an econometrically reliable

way to link customer value to sales, and a statistically robust way to

quantify the relative lift potential of the different strategic areas driving

customer value.

The 2024 Stratonomics B2B™ study, “Customer Value in the Oilfield

Service Sector,” provides the necessary framework. The study, based on

2,620 respondents who rated different OFS suppliers. It is part of the

larger Stratonomics B2B™ Tracking Study of more than 40,000 customers

of over 6,000 B2B companies. The research represents one of the

largest and most comprehensive studies of customer value among B2B

companies ever conducted.11

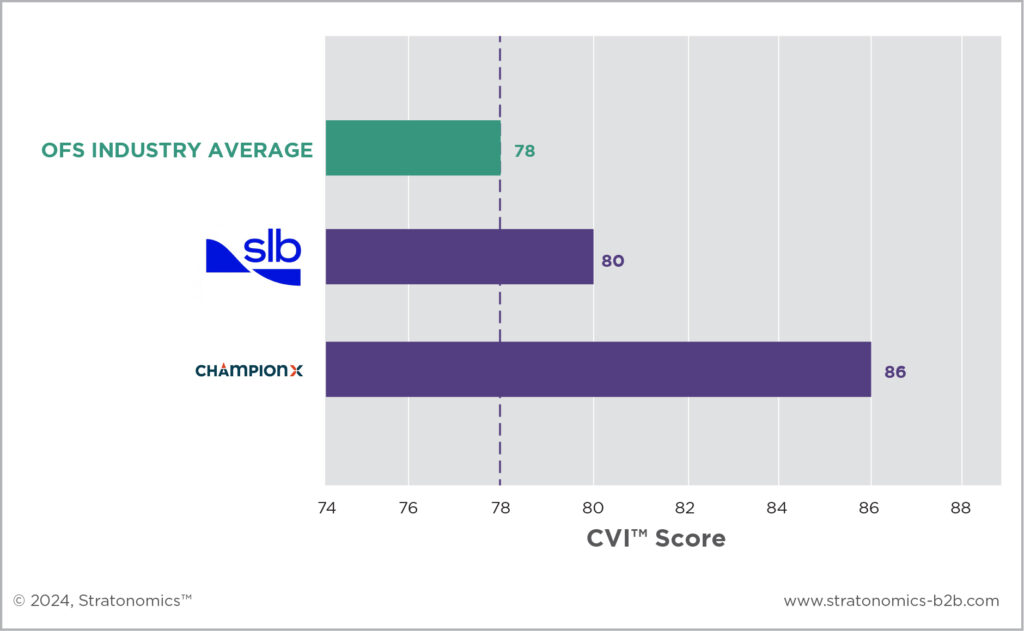

The proprietary Stratonomics CVI™ Score provides B2B suppliers a

summary measure of their customers’ judgement of the overall value

they receive. The score can range from 0 to 100, with 100 representing

the highest level of customer value. Companies use CVI™ Score in strategy

planning because it reliably links to customer recommendations

and retention, as well as sales, margins, and stock price.12

Figure 2 shows the relative CVI™ Scores for SLB and ChampionX.

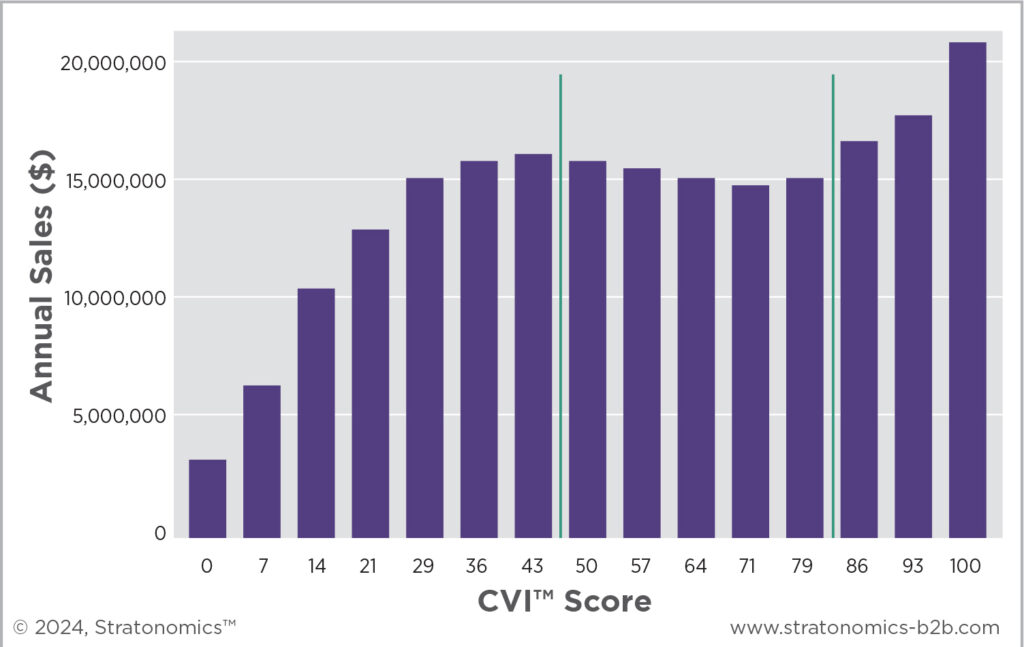

Figure 3 shows the relationship between OFS companies’ CVI™ Score

and sales.

When two companies merge, the larger of the two frequently integrates

the smaller into its tactics, processes, operations, and strategy. Instead,

merging firms should consider customer satisfaction when making

integration decisions.

When commercial airlines United and Continental merged in 2010,

United’s customer satisfaction score was 56, while Continental’s was

68. Observers hoped the newly-merged company’s satisfaction rating

would veer toward the higher score via Continental’s best practices,

rather than gravitating toward the larger firm’s lower score.13 Today,

United scores 77 on customer satisfaction, 1 point behind Southwest

and American and 1 point above the sector average.14

ChampionX has a higher CVI™ Score than SLB, at 86 to 80, though both

score above the sector average of 78.

Executives at the merged company must work to make SLB more like

ChampionX and increase the new entity’s CVI™ Score. Allowing the new

firm to gravitate toward SLB’s lower CVI™ Score would erode customer

value, decrease sales, and eventually decrease shareholder value.

As shown in Figure 3, the relationship between an OFS company’s CVI™

Score and sales is non-linear. Having an above average CVI™ Score is

not enough for a firm in the OFS sector to gain sales. Up to a score

of 85, OFS companies’ sales remain flat; sales increase only after their

CVI™ Score exceeds the threshold. While ChampionX is in the sales

upliftment zone, SLB is not. If the merged entity’s CVI™ Score were

pulled down toward SLB’s score, the new firm’s sales would stagnate

or decline.

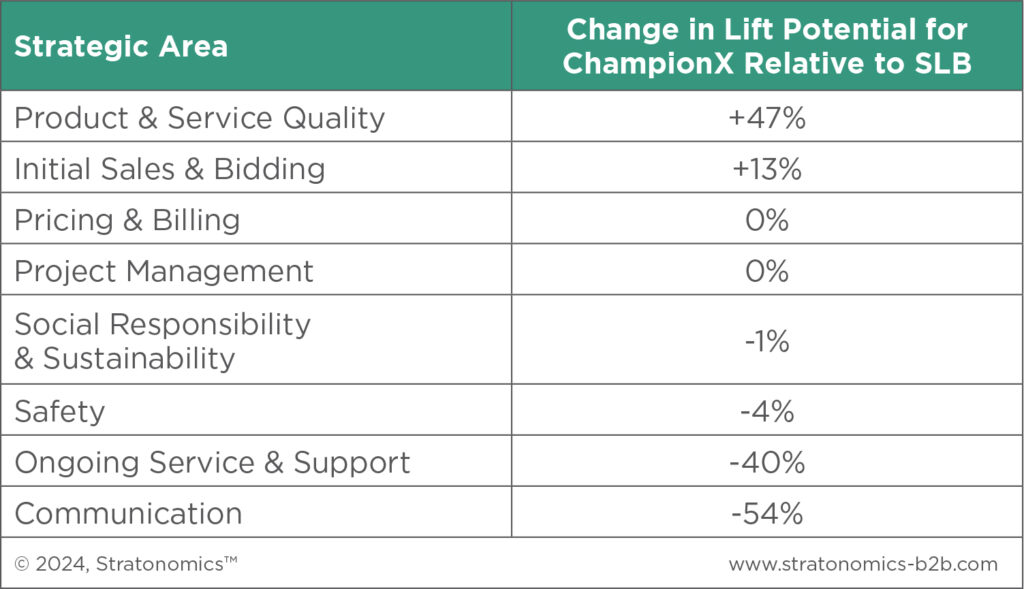

Figure 4 shows the eight strategic areas driving CVI™ Score in the OFS

sector. The eight strategic areas offer varied CVI™ Score lift potential.

The lift potential of a strategic area is a measure of the improvement in

CVI™ Score that results from improvements the area. OFS companies

should prioritize strategic areas with the highest lift potential.

Table 1 compares the lift potential of the eight strategic areas for SLB

and ChampionX. The baseline shown is SLB’s lift potential; the table

shows the relative change in lift potential for ChampionX.

• The lift potential for “Communication” (-54%) and “Ongoing Service

& Support” (-40%) is drastically lower among ChampionX customers

than it is for SLB customers. Relative to SLB, ChampionX’s CVI™ Score

is 54% less responsive to “Communication” improvements and 40%

less responsive to “Ongoing Service and Support” improvements.

• ChampionX’s customers value “Product & Service Quality” 47% more

than SLB’s customers.

• The lift potential is identical or similar for both companies among four

strategic areas—“Safety” (-4%), “Social Responsibility & Sustainability”

(-4%), “Pricing & Billing” (0%), and “Project Management” (0%).

The merging companies should not use a one-size-fits-all approach to

managing customer value after the merger. More specifically:

• ChampionX should intensify its emphasis on “Product & Service

Quality.” An additional analysis shows that ChampionX’s performance

score on this strategic area is 8% higher than that of SLB, despite its

lift potential being 47% higher.

• SLB should intensify its focus on “Communication” and “Ongoing

Service & Support.” Despite the strategic areas’ high lift potential,

SLB’s performance score in them is 4% and 8% lower than that of

ChampionX.

Research shows that, despite their best intentions, merging companies’

leaders often become obsessively focused on financial efficiency while

ignoring customer value. The misplaced focus saps shareholder returns.

The SLB–ChampionX merger is a monumental opportunity for both

companies. Executives can simultaneously increase customer value and

shareholder returns by implementing a research-based framework that

is mindful of the following:

• Although executives at most merging companies focus on wresting

efficiencies, the most effective M&As focus on increasing customer

value, the most reliable way to improve sales, margins, EBITDA, and

stock price. SLB and ChampionX should make an intentional effort to

focus on customer value to drive the merger’s success.

• SLB should not try to integrate ChampionX into its existing customer

strategy. Research shows that SLB customers are driven by different

considerations than are ChampionX customers. Specifically:

° ChampionX should improve it’s already high CVI™ Score by focusing

on excellence on “Product & Service Quality” execution levers.

° SLB should focus on driving its CVI™ Score into the sales upliftment

zone (i.e., a score above 85) through excellence on execution levers

driving “Communication” and “Ongoing Service & Support.”

By understanding the unique and common strategic areas important

to their customers, both companies can maximize their CVI™ Score and

sales, thereby growing shareholder returns.