The multibillion-dollar oilfield services (OFS) market is forecast to show an average annual growth rate of 5.9% through the year 2030.1 As global energy demand continues to rise and mature resources are depleted, OFS providers must uniquely navigate price volatility, geopolitical uncertainty, and growing environmental concerns to satisfy their customers.2

OFS customers need timely and relevant information to chart potential headwinds and make informed decisions about the latest technological advances, process improvements, and market opportunities. To understand the customers’ perspective, Stratonomics-B2B™ sought to pinpoint where they gather information and identify potential multichannel approaches to effective information exchange.

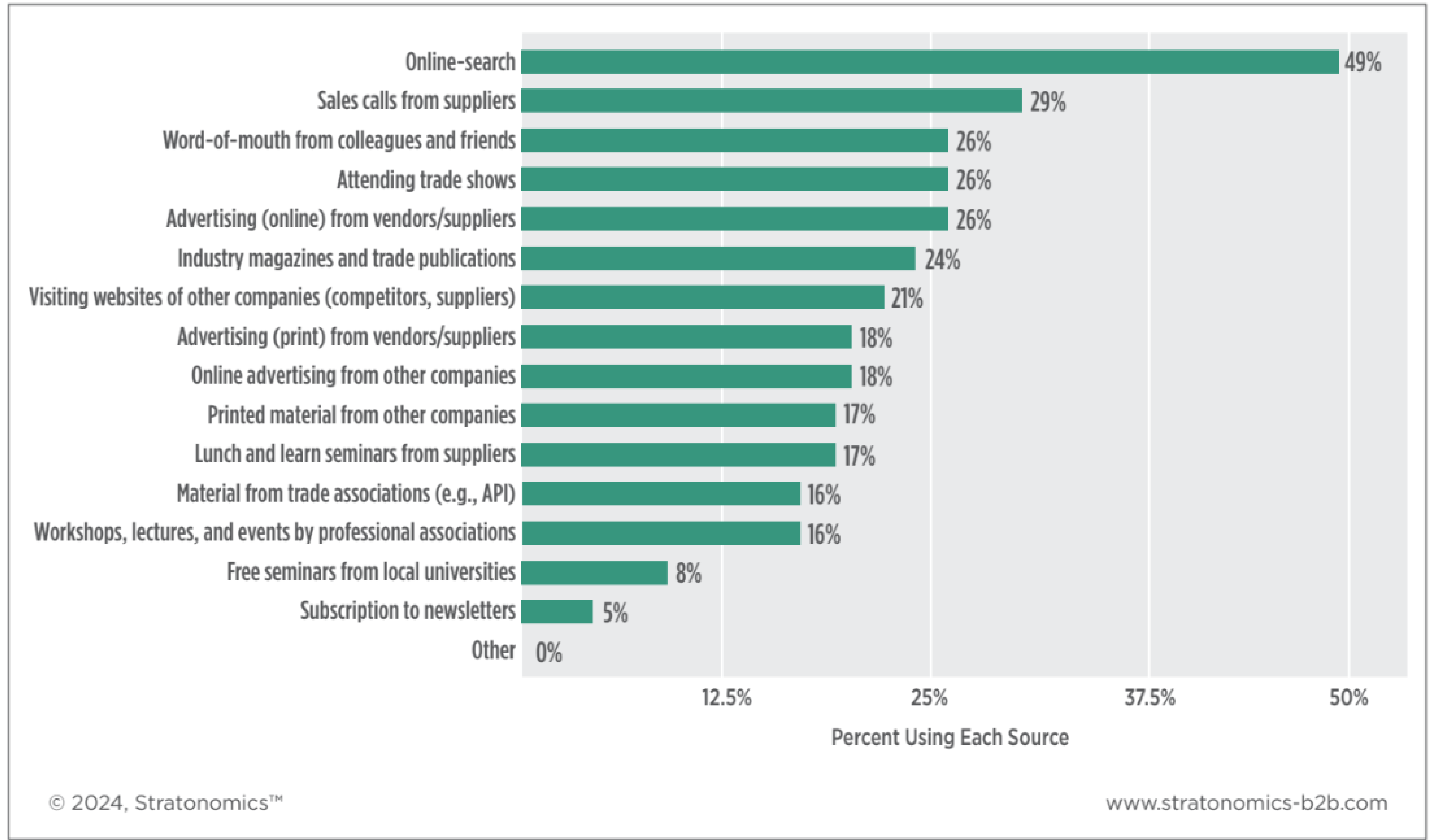

Stratonomics-B2B™ asked 936 OFS customers about their use of diverse information sources for decision making. Each respondent indicated the sources he or she uses to stay informed on industry trends and other useful data points. The results enabled Stratonomics-B2B™ to identify preferred media channels in the OFS sector.

The study’s results in Figure 1, show OFS customers engage with multiple channels to learn about industry trends and information:

• Nearly half of respondents (49%) use online search to learn about industry trends; 26% gather information from advertising.

• About one third (29%) value sales calls, and 17% attend lunch-andlearn seminars put on by suppliers.

• Attending trade shows (26%), reading material from trade associations (16%), and attending university events (8%) and workshops/events by professional associations (16%) are another critical information source.

• Over one quarter of respondents obtain information via word-of-mouth from colleagues and friends (26%).

A 2023 review of 128 academic papers3 noted that understanding customer channel preference is critical for effective reach and utility. Based on the research, OFS suppliers might consider the following to optimize multichannel engagement:

• Invest in your online presence, via both search returns and advertising.

° Use paid and organic search to elevate your profile.

° Create relevant and accessible content.

° Audit competitive profiles and placements.

• Enhance direct selling approaches to build stronger relationships.

° Invest in a well-trained and enthusiastic sales team.

° Build a robust pipeline of relevant technical and nontechnical seminars for customers.

• Incorporate broad information ecosystems into your multichannel

approach.

° Build and leverage relationships with trade associations, universities, and other professional organizations to identify potential event opportunities.

° Work with industry influencers and educate them on your solutions.

° Collaborate with local universities to provide industry data.

• Rationalize traditional approaches within your engagement strategy.

° Printed materials, print advertising, and tradeshow collateral can be useful but should not be your primary focus.

OFS companies produce voluminous information about technological advances, process improvements, customer solutions, and market opportunities. Finding the right marketing channel mix to engage customers and other stakeholders is critical.