Growing the customer base—organically and inorganically—is a key strategic objective for most business-to-business companies. To that end, B2B firms expend enormous resources on sales growth strategies.

Companies often gauge market potential using the TAM/SAM/SOM approach, which examines total addressable market, serviceable-available market, and serviceable-obtainable market. Then companies use the model to develop a sales strategy to conquer their serviceable-obtainable market. The approach yields a sales target the company can address, and the B2B firm’s strategy ultimately coalesces as the projected budget investment needed to meet the target.

On average, B2B companies invest 2% to 5% of their gross revenue on sales strategies, a combination of lead generation-development-conversion approaches and brand activities.1 A typical B2B company with target revenue of $100 million may invest anywhere between $2 million and $5 million on advertising, trade shows, and sales activities directed at new customers.

By and large, B2B executives make these investments based on gut feel, intuition, and guesswork. Conversations with executives reveal several trends.

• Updating model. Some companies update spending on in-person sales, online advertising, tradeshows, and other categories from one year to the next based on executives’ gut feel and intuition. The updating can be bottom-up (i.e., separate updates for each category or market are totaled for a topline number) or top-down (i.e., a single amount is allocated to different categories or markets).

• New customer acquisition prioritization. Most B2B companies focus their sales and marketing budget on new customers. They rely on an unwritten stipulation to prioritize new customer acquisition as their primary sales growth focus.

• Vendor-driven spending. Some companies base their investments on vendors’ advice, which can introduce biases. For example, Salesforce suggests that activities like sales calls and email newsletters are more effective than branding activities like white papers, blog posts, and thought leadership articles.2 Another digital marketing and trade show consulting firm recommends companies focus on industry conferences/expositions and website marketing to grow sales.3

Lacking precise data, measurement, and guidance, B2B companies continue spending millions on sales growth strategies that fail to resonate with current or potential clients. The approach leads to wasted resources, sluggish sales growth, elevated customer acquisition costs, and a low-quality customer base.

To accelerate their B2B company’s growth strategy, C-level executives must answer several critical questions:

• What is the relative effectiveness of different customer growth strategies? Specifically, how do the following strategies compare?

° Online advertising versus sales visits with customers.

° Referral from existing customers versus online advertising.

° Trade shows versus print media.

° Growing business with existing customers versus sales calls.

• How did the onset of the Covid-19 coronavirus pandemic change the effectiveness of each sales growth strategy? Specifically:

° Which strategies are preferred by customers?

° Did preferences for trade shows, print media, and sales calls increase or decrease after Covid?

° Did preferences for online advertising increase or decrease after Covid?

Conducted since 2017, the Stratonomics-B2B™ Study is based on data from more than 40,000 customers of over 6,000 B2B companies. It is the largest and most comprehensive study of B2B managers ever conducted.

The Stratonomics-B2B™ Study draws on input from 44,822 participants. Each participant completes a proprietary assessment of a B2B company on its performance in eight strategic areas and overall customer value. Participants also provide loyalty metrics, price elasticity, key behaviors, demographics and firmographics.

There are two ways to measure the prevalence of growth strategies among B2B companies.

Asking chief sales, marketing, and executive officers. One approach is to ask B2B company executives which strategies they use, how much they spend on each, and whether they believe each practice is successful.

However, this method is confounded by three strategy inhibitors: salience, intuitive leaps, and egocentrism. To CSOs, CMOs, and CEOs, the growth practices of their company will seem relevant (salience), prone to drive success (intuitive leap), and prevalent among other companies (egocentrism).

Asking B2B customers. A better way to capture prevalence is to ask a representative sample of B2B customers about a specific vendor they have used. Next, each customer could check the different growth strategies its vendor used to get their business. The approach can provide a relatively unbiased measure of growth strategy prevalence.

To reliably and simply frame the growth strategy question, the Stratonomics-B2B™ Study directly asks customers how they learned about a vendor instead of asking B2B companies’ executives how they grow their business. Specifically, each B2B customer is asked:

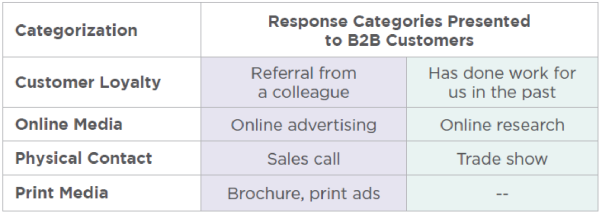

The results in Figure 1 (see the following page) have three important features:

1. Multiple options chosen. Because B2B customers can choose multiple options, the totals in Figure 1 add up to more than 100%.

2. Response categorization. To simplify the analysis, the options are categorized in four groups:

3. Covid-19 comparison. Executives at many B2B companies disagree about how their customers have shifted behavior since Covid. For example, some believe that Covid decelerated B2B customers’ reliance on physical contact (e.g., in-person sales) and print media.

To gain insight, the Stratonomics-B2B™ Study compares growth strategies during three time periods:

• Pre-Covid (2017–2019)

• During Covid (2020–2022)

• Post Covid (2023–2024)

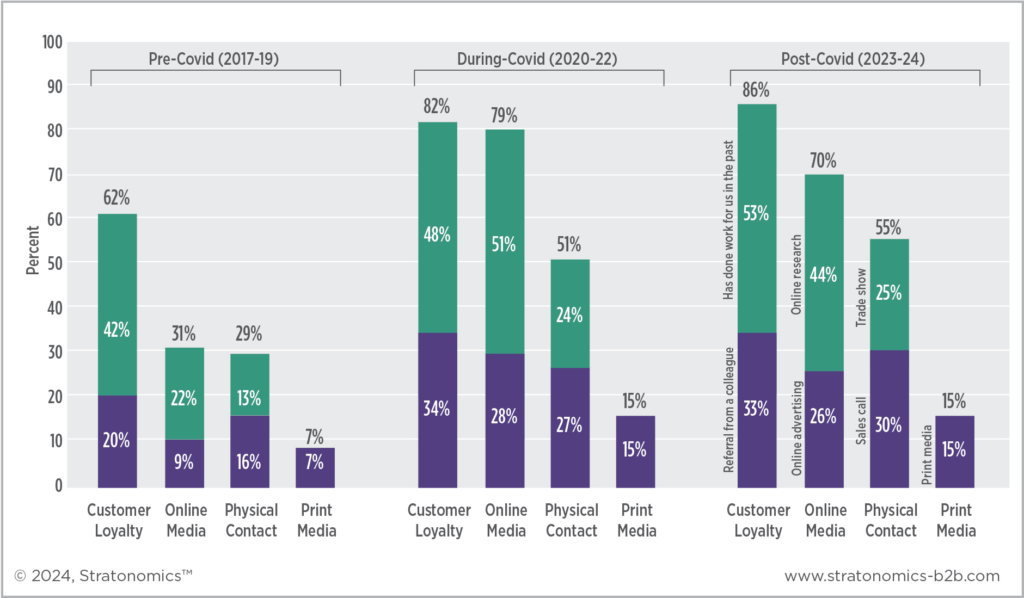

Figure 1 supports several conclusions:

1. Customer loyalty is tops. In all three time periods, customer loyalty emerges as the top growth strategy. Between 62% and 86% of customers use a supplier that has already done work for them in the past and/or was referred to them by a colleague. When it comes to growing their customer base, some CSOs and CMOs focus exclusively on new customers. It may be more effective to focus on current customers who can help grow sales through referrals and repeat business.

Covid effect. Customer loyalty strategies (i.e., repurchase and referral) grew from 62% in the pre-Covid era to 82% during Covid and 86% in the post-Covid era. Today, the fastest, most reliable, and cheapest way to grow sales is to nurture your B2B company’s existing core of profitable customers. Highly satisfied current customers give you repeat business, buy more from you through cross selling, refer you to others, and continue buying even when competitors lower prices.

2. Online media is increasingly important. Most executives understand the need for a strong online presence, but they might not recognize its continued growth. More and more B2B customers use online research (44%) and rely on online advertising (26%) to find suppliers.

Covid effect. Pre-Covid, 31% of B2B customers found suppliers through online research/advertising. The proportion rose dramatically during Covid to 79%, but it has since declined to 70%. B2B companies increased their online spending dramatically during Covid, but a continued ramp up does not appear warranted. A judicious analysis is necessary to optimize online spending.

3. In-person interaction should not be ignored. Today, sales calls (30%) and trade shows (25%) are the source of business for more than 55% of B2B customers. B2B executives must not underestimate the importance of human interaction. Sales visits and tradeshows play a critical role in educating customers. A strong presence at trade shows can boost your brand and help potential clients learn about your business. Along with a strong online presence, in-person initiatives boost customer acquisition.

Covid effect. Pre-Covid, 29% of B2B customers preferred suppliers offering physical contact. The proportion increased to 51% during Covid and has grown to 55% post-Covid.

4. Print media. Today, print media is limited as a driver of sales growth (15%), partly because most traditional media is also digitally available online.

Covid effect. Pre-Covid, print media was preferred by 7% of B2B customers. During and after Covid, it has remained stable at 15%.

• Customer loyalty strategies—referrals and repeat business—have increased as a driver of sales growth and will likely continue to increase. Underestimating your current customers to chase new customers is an ineffective strategy. CSOs and CMOs should be wary of chasing new customers unless they can satisfy their existing customers.

• Online media continues to be an important source of customers, though its impact is moderating. Customers’ relative preference for online media should not cloud the work your sales team does. In a post-Covid world, customers’ preference for in-person interaction has grown.

• In terms of investments designed to grow sales, the Stratonomics-B2B™

Study shows:

° Firms’ biggest and best investments should be in satisfying their current customers.

° Companies should invest in a robust online infrastructure so customers can find them through online research and advertising.

° Firms should not consider online interaction a substitute for physical contact; customers’ preference for sales contact and trade shows has grown since Covid.