Business-to-business (B2B) executives use various strategies to grow their sales, margins, and EBITDA (earnings before interest, taxes, depreciation, and amortization). Consider the following:

• The chief sales officer (CSO) evaluates different markets and develops strategies to enter them through sales targets, sales plans, and go-to market strategies.1 The approach is intended to increase requests for proposal, win rates, and sales.

• The chief finance officer (CFO) works with the CSO to set sales and growth targets. The CFO expects to grow sales through mergers and acquisitions of smaller competitors or adjacent companies and helps set annual sales targets.

• The chief operating officer (COO) is tasked with finding efficiencies, optimizing processes, and implementing cost-cutting measures to grow margins and EBITDA. The COO works with the CSO to ensure smooth execution and order delivery.

• The chief commercial officer (CCO) helps with proposal preparation, develops pricing plans, negotiates contracts, and oversees project execution, with a goal of increasing the top line and margins. The CCO works with the CFO, CSO, and COO to oversee projects’ financial and operational aspects.

• The chief human resources officer (CHRO) launches plans to motivate and engage employees, believing they will work harder and grow the company.

• The chief marketing officer (CMO) launches a new branding and online engagement campaign to strengthen customer relationships. Each executive strongly believes he or she is focused on creating customer value.

To wit, the CMO and CSO believe they are growing sales by strengthening customer relationships through branding, market growth, and customer communication. The CCO thinks pricing, contract negotiation, and project execution are intricately linked with sales growth. The CHRO believes a focus on employee engagement will help grow sales. The COO stresses that cost cutting will eliminate wasteful initiatives and help employees focus on activities that increase sales. And the CFO’s critical contribution, setting sales targets, is seen as a main driver of sales growth.

If sales grow, each executive lays claim to the outcome. “An accretive acquisition was the driver of sales growth this quarter,” the CFO says. The CMO credits the growth to the new branding campaign. Meanwhile, the CHRO claims a correlation between employee engagement and sales. The CSO points to the bids submitted as a key factor. And not to be outdone, the COO says aggressive cost-cutting increased margins and EBITDA.

If sales stagnate or decline, the blame game begins. One favorite culprit is unanticipated competitor activities. Other culprits are macroeconomic and geopolitical factors—inflation, supply-chain issues, and armed conflicts, to name a few. Executives may ask their CEO to be patient. “We just started—it will take a couple of quarters for the strategy to work,” they say. In other cases, executives may take partial credit while expressing frustration with others. “We’re aggressively cutting costs, but unless the sales team improves, we won’t see the margin gains,” the COO says.

Most CEOs recognize the problem. “At the end of the day, I am accountable for increasing sales, margins, and EBITDA. I rely on the executive team to set sales targets and deliver,” said the CEO of a recycling company with more than $700 million in revenue. “But each quarter, it’s the same old, same old. If sales grow, everyone claims credit. If they don’t, no one wants to own the issue. And we get progressively disengaged from customers. We don’t even know if and how we are providing value.”

B2B CEOs face a paradox. Many senior executives believe they are externally focused on measuring, creating, and enhancing customer value. But most of their real-time focus is internal. They spend time on mergers and acquisitions, cost-cutting, strategic initiatives, employee engagement, market sizing, go-to-market strategies, commercial contracts, and communication campaigns that are directed toward customers.

The executives justify their internally focused activities by saying they increase sales, margins, and EBITDA. But absent from their justification is any mention or measurement of customer value.

Most B2B companies have no systematic way to measure customer value and link it to financial outcomes. Few B2B companies measure customer value at all. If they do, they are unable to link it to financial outcomes like sales, margins, and EBITDA.2

Some B2B executives suggest they don’t need to measure customer value or link it to financial outcomes. “We are not a failing business,” they say. “We know how to run our company, and we’ve done a decent job so far.” Others believe there is no way to establish a valid and reliable customer value measure that can predict sales, margins, and EBITDA: “Lacking an effective customer value metric, our company has no other choice than to rely on executives’ gut feel, hunches, and pre-existing beliefs.”

A customer-focused strategy is predicated on creating and increasing customer value. A company creates value for its customers when the largest proportion of its customers judge that a product or service has satisfactorily provided the value they expected and were promised by the company.

To implement a customer-focused strategy, B2B companies need a customer value measure that:

1. Is simple, valid, and reliable; and

2. Predicts financial outcomes likes sales, margins, and EBITDA.

With such a metric, CEOs can hold senior executives accountable and measure their firm’s success against customer value.

The Stratonomics B2B™ Customer Benchmark Study has tracked overall customer value and its drivers among more than 40,000 customers of over 6,000 B2B companies since 2017. The study represents the largest known research sample of B2B customers.

Customer Value Index (CVI™). Each customer provides an overall CVI™ score for a B2B supplier. The CVI™ score measures customers’ judgements of the overall value received from the B2B supplier.

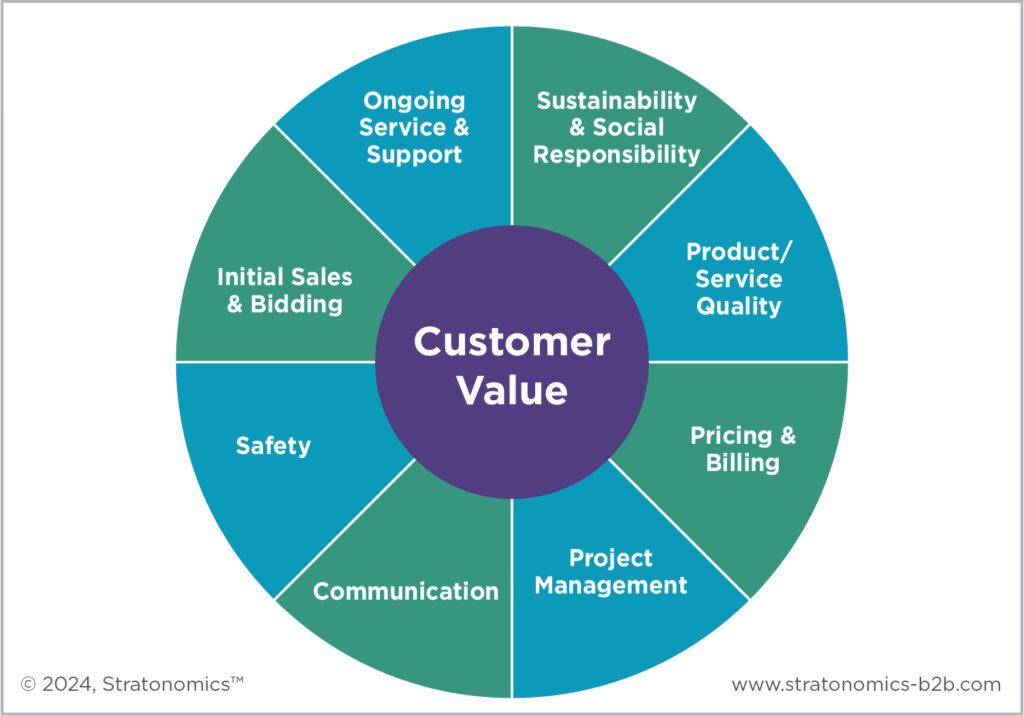

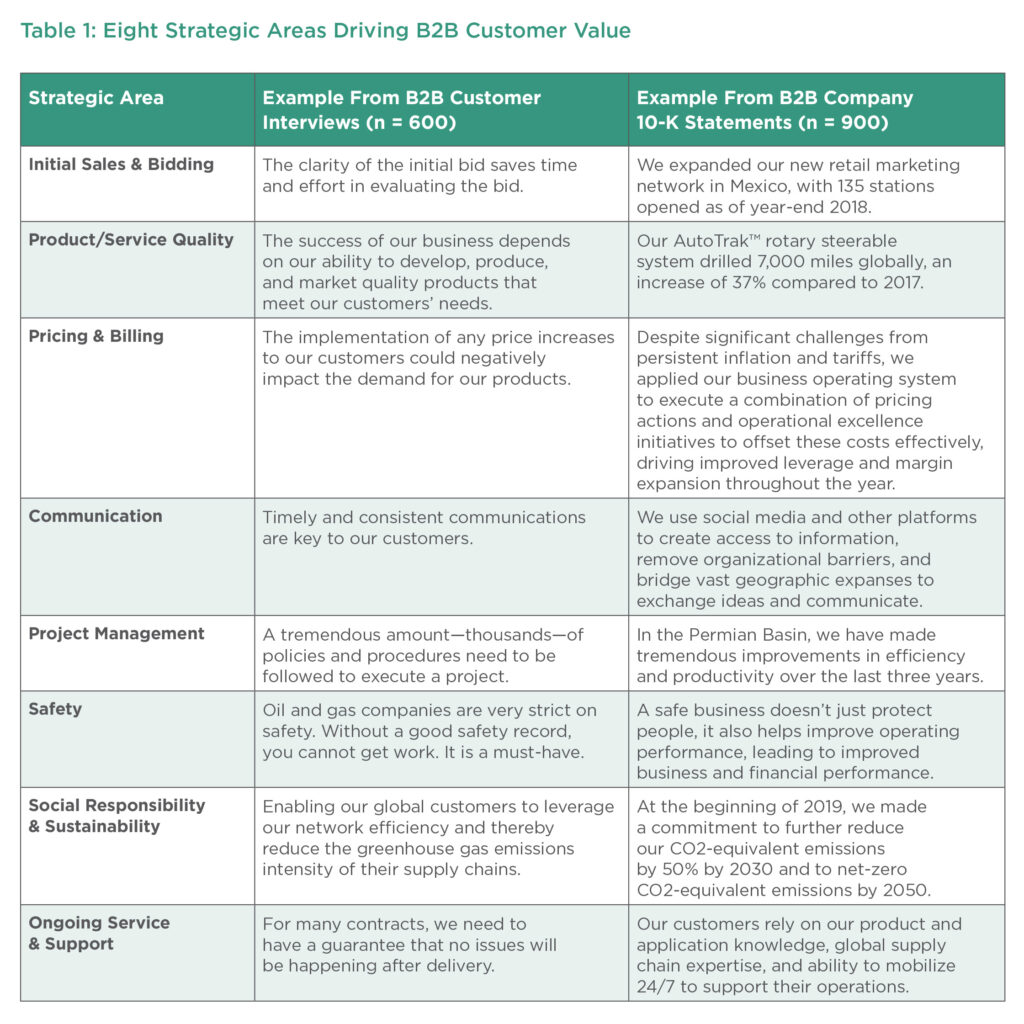

Strategic Areas Driving Customer Value. We have determined a validated set of eight strategic areas that drive customer value. The eight areas are shown in Figure 1, with examples given in Table 1.

The customer value drivers:

• Represent the entire engagement cycle of a B2B customer, from sales and bidding to ongoing service and support.

• Account for 70–85% of overall customer value for individual firms.

• Apply universally to all types of B2B firms in virtually every sector.

• Are used by more than 100 B2B firms in their strategic planning process.

• Demonstrate high statistical reliability and validity, confirmed by research studies published in top peer-reviewed journals.3

• Enable CEOs to formulate and implement customer-focused strategies.

Stratonomics B2B™ uses a statistically rigorous methodology to assess the link between companies’ CVI™ scores and three financial outcomes: sales, margins, and EBITDA.

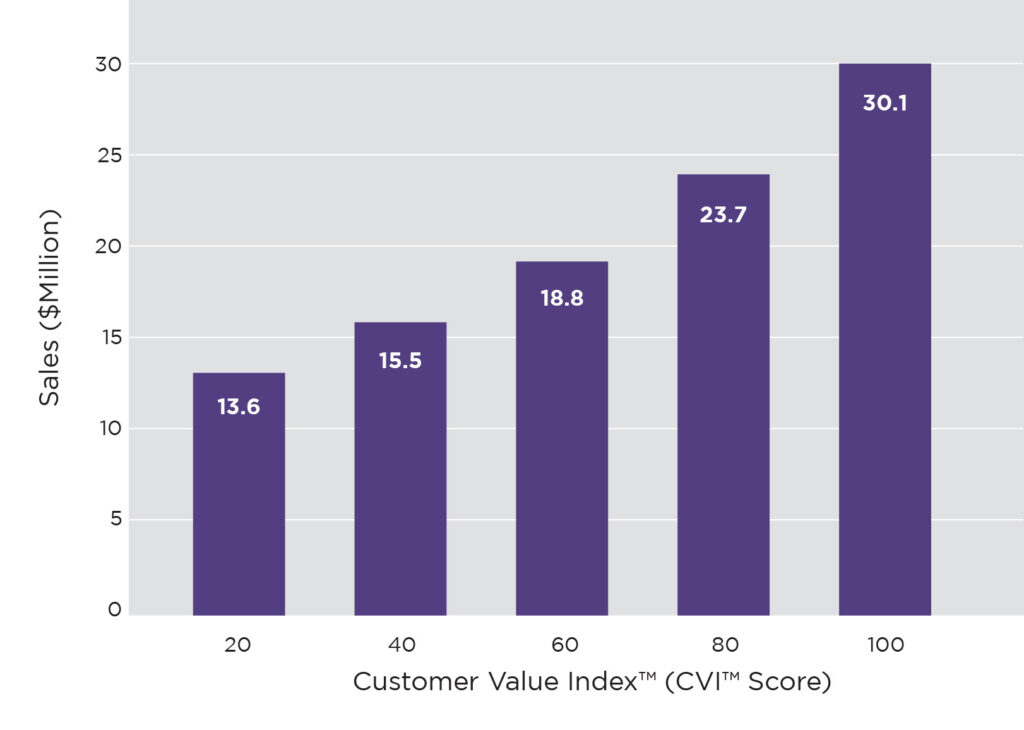

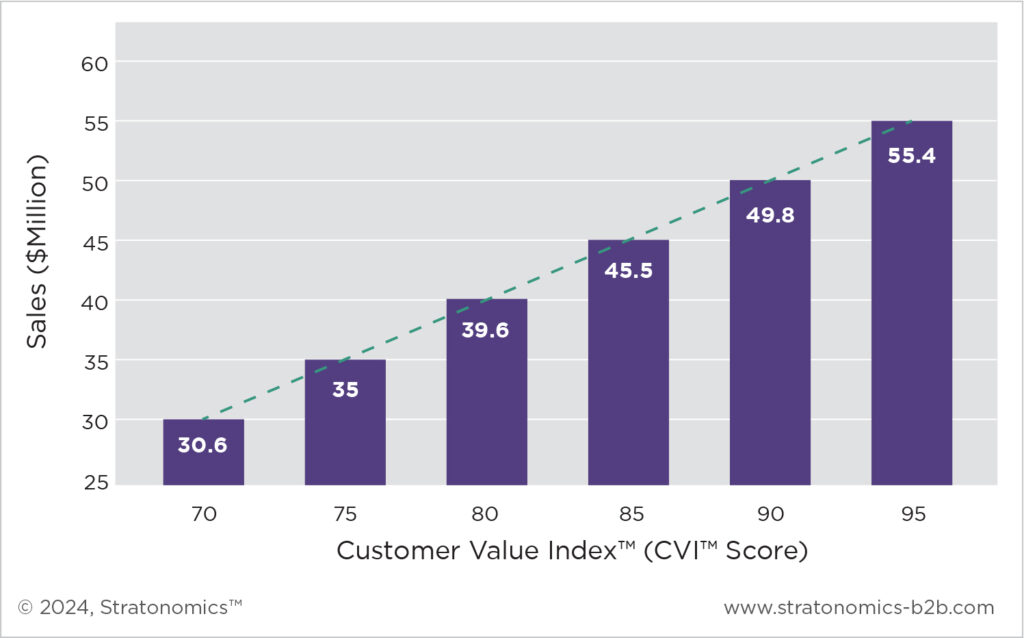

CVI™ Score and Sales. Figure 2 shows the association between B2B companies’ CVI™ score and sales. Statistical analysis shows the association is unambiguously strong and positive. B2B companies can strategically grow sales by increasing their CVI™ score. Moreover, CVI™ provides a common strategy planning framework to focus and sequence senior executives’ work on the single strategic area that provides the biggest lift in customer value.

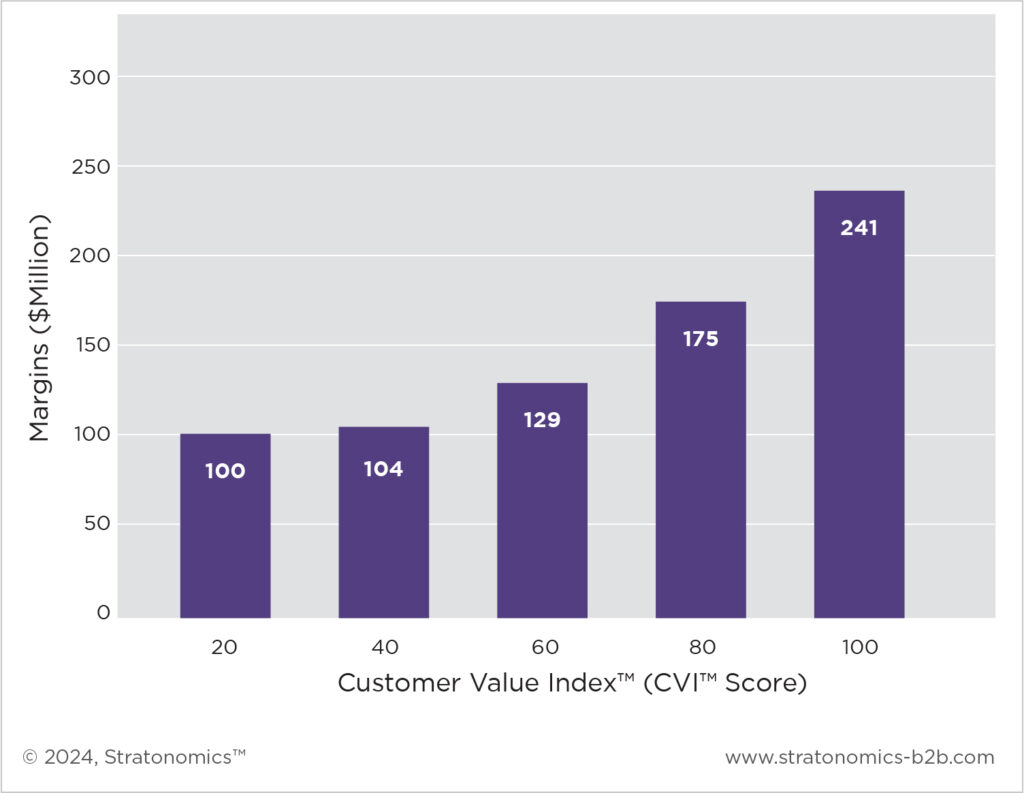

CVI™ Score and Margins. Figure 3 shows the association between B2B companies’ CVI™ score and margins. We scale the scores for ease of interpretation—a CVI™ of 20 is pegged to a margin of 100, scaled based on the firm’s actual margins. A company with a CVI™ score of 100 has 2.4 times higher margins than a company with a CVI™ score of 20. Strategically, companies can grow their margins by increasing their CVI™. When companies focus and sequence senior executives’ work on the one strategic area that provides the biggest lift in customer value, they reduce costs and increase margins.

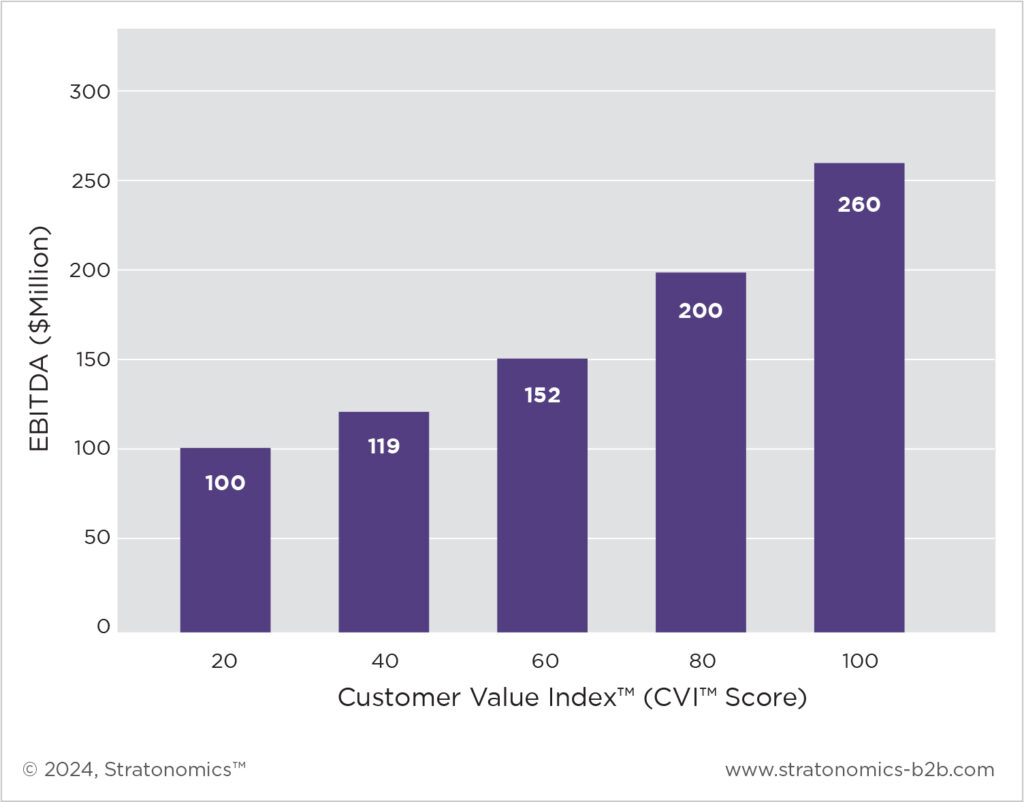

CVI™ Score and EBITDA. Figure 4 shows the association between B2B companies’ CVI™ score and EBITDA. The scores are again scaled, with EBITDA scaled to 100 for a company with a CVI™ of 20. A company with a CVI™ score of 100 has 2.6 times greater EBITDA than a company with a CVI™ of 20.

The CEO of an automation parts distribution company with $45 million in annual sales was frustrated with his firm’s strategy planning and implementation process. The company’s 12-member executive team was working on more than 30 disparate initiatives, most of them internally focused. The executives’ idea of providing customer value was to have frontline employees do anything and everything individual customers requested.

The executives remained focused on internal tasks—financial planning, commercial engagement, favored initiatives, and employee engagement. CJ, the CEO, decided to use CVI™ to close several strategy gaps in the company’s approach.

Strategy Alignment Gap. A survey revealed a wide strategy gap among the executives. While they believed they had a 93% agreement level on strategy, their actual agreement was relatively low, at 22%.

“The 71% alignment gap is alarming but not surprising,” CJ said. “It’s a relief to finally measure it and start the strategy work. Senior executives believe they are dedicated to customers, but we don’t even measure customer value and have no way to relate it to financial performance.”

Elaborating further, CJ diagnosed the problem. “We are good at customer appeasement—at running many initiatives and completing projects,” he said. “But we don’t have any measure of customer value, and we have no idea of how to become customer focused. We need to formulate a customer-based strategy.”

Strategy Formulation Gap. An assessment of more than 360 clients measured CVI™ and related it to the company’s sales. Figure 5 shows the strong association between the company’s CVI™ score and sales. The results provided CJ enough evidence and basis to formulate a strategy based on increasing customer value.

Further statistical analysis showed that the biggest increase in customer value came from providing timely quotes. The discovery provided a strategy implementation framework. “We can now focus all our time, attention, and energy to decreasing the time to quote,” CJ said. “We are at an average of 16 hours, and we should be at five hours.”

Strategy Implementation Gap. The firm’s senior management team focused on decreasing time-to-quote. They paused, deferred, or scrapped many unrelated initiatives. For two quarters, the team dug deep and fixed all issues related to quoting. The process involved all executives, and finally, the company was reliably quoting more than 91% of requests in less than four hours.

Strategy Monetization Gap. Because they were no longer chasing quotes, salespeople had 20% more time at their disposal—one full day of customer visits for each salesperson. More importantly, the entire sales team underwent training to interact with customers in a way that highlighted rapid quoting. Previously, they sold based on many disparate value drivers, including “quality products,” “competitive pricing,” “service,” “safety,” “relationship building,” and others. After learning how to sell based on rapid quoting, the team members became more focused and efficient. They completed more sales calls, received more quotes, and won more orders than they previously believed possible. Within two quarters, they were increasing sales at a faster rate than their competitors.

Sales and Margin Growth. Over time, the automation parts distribution company grew sales to more than $80 million while expanding margins by 2 percentage points.

“The incredible sales growth was achieved without having to hire more employees,” CJ said. “We trimmed many activities that seemed important but were unrelated to customer value. We are now a more focused company. More than financial results, customer value has fundamentally altered the DNA of our company. We are focused, delivering more value to customers and even more value to shareholders.”

Customer value, as measured by a company’s CVI™ score, is reliably associated with sales, margins, and EBITDA—crucial metrics for any CEO. CVI™ also provides a systematic way to formulate and implement strategy that grows sales, margins, and EBITDA.

The CVI™ impact observed by Stratonomics B2B™ is consistent with a growing body of academic studies showing that the best way to increase financial performance is to start with customer value.4

Vikas Mittal, Ph.D., has published more than 100 articles on customer focused strategy and worked with senior executives at more than 200 organizations. He is the co-author of a 2021 book, FOCUS: How to Plan Strategy and Improve Execution to Achieve Growth, and a 2023 book, Market-Based Management, (7th edition).

Mittal, Vikas (2024), “The B2B growth equation: Improving sales, margins, and EBITDA with CVI™,” STRATONOMICS© Insight Series, 1–14.