According to the Pew Research Center, energy use and conservation is a major point of debate and discussion among the general public and energy industry stakeholders.

A 2014 survey of more than 1,000 U.S. residents showed a trust gap between the general public and oil and gas companies.1 Asked how much faith they had in oil and gas companies to provide information on conserving energy, fewer than one in five ranked the companies as “very trustworthy.” In contrast, federal agencies like the Department of Energy and Environmental Protection Agency were perceived as very trustworthy by 24% of respondents, while environmental groups and the academic/scientific community were rated as very trustworthy by nearly half of the U.S. residents surveyed.2

The Stratonomics-B2B™ Study takes the research further, specifically measuring the opinions of energy industry insiders, including customers, employees, managers, executives and vendors in the sector. The research and its results provide oil and gas company leaders rare insight into the perspective

Since 2017, the Stratonomics-B2B™ study has measured the degree to which energy industry insiders trust different sources of information about how to use energy efficiently. The results are based on responses from 7,784 industry participants.

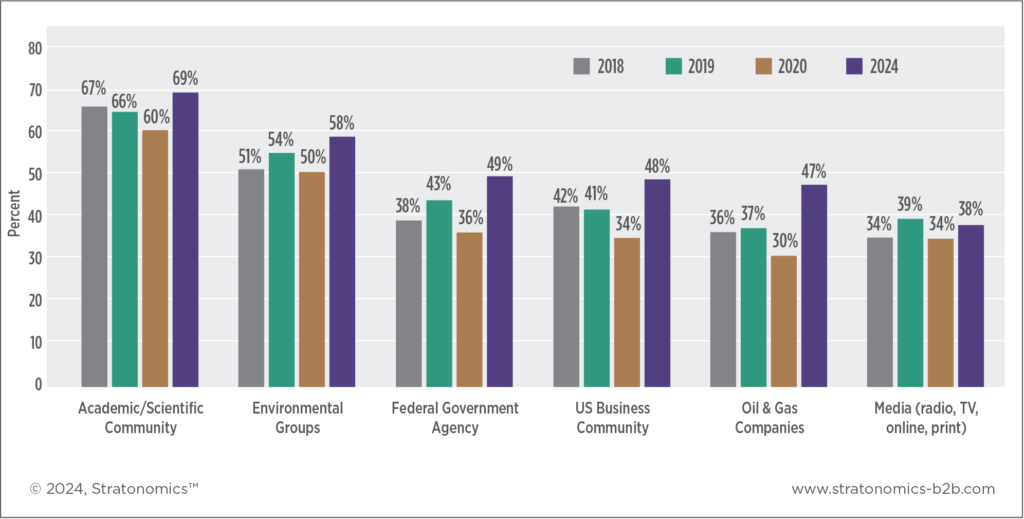

Figure 1 summarizes the results of the energy industry-specific Stratonomics-B2B™ study. It shows a trust score for different institutions over time.

Key conclusions from the study include:

• In 2024, energy industry insiders trusted the academic/scientific community most (69%), followed by environmental groups (58%). The trend has been consistent since 2018.

• Since 2017, media has been the least trusted source on efficient energy use (38% in 2024).

• In 2024, a higher proportion of industry insiders (49%) trusted federal government agencies than in previous years (36% to 43%). The same is true of the general business community, whose trust score increased to 48% in 2024.

• Oil and gas companies had a historically low trust score from 2017 to 2020, ranging from 36% to 30%. In 2024, their score increased sharply to 47%.

• Trust is multifaceted. The extent to which stakeholders trust a company as a source of information on one topic reflects a broader level of trust across issues. Developing, maintaining, and growing general trust among energy industry stakeholders is therefore vital.

• The 2024 results show a 17-percentage point increase in trust for oil and gas companies (from 30% in 2020 to 47% in 2024). Still, oil and gas companies remain 22 percentage points behind the academic/scientific community on trust (69% versus 47%).

• Oil and gas companies can focus on building academic partnerships to boost their credentials, specifically through joint research and advisory relationships.

• Strong, cooperative relationships with environmental groups can also be helpful for building trust among stakeholders.

The industry in which a company operates provides the institutional context for its success. Over time, a company’s effectiveness depends on the extent to which industry insiders place trust in it. Insights from this report can help oil and gas companies build a multipronged strategy for generating and increasing trust.