Companies base almost every M&A transaction on the premise that it will increase shareholder value and customer value. Company leaders invariably commit to wresting efficiencies and synergies to enhance shareholder value.

A 2022 landmark study published in the prestigious Journal of Marketing examined M&A’s effect on customer and shareholder value and its underlying mechanism. The authors gathered data from 141 firms from 1995 to 2017, yielding 1,395 data points.

The study compared firms undergoing an M&A (M&A-firms) to themselves before and after the transaction, as well as to a control group of companies undergoing no such change (non-M&A firms). The study’s sample and econometric methodology enable unambiguous and statistically valid conclusions. Specifically, the study statistically removed the confounding effect of multiple extraneous factors such as: year in which M&A occurred, market share, ROA, industry type, sales, market growth, advertising, R&D, firm size, firm growth, firm scope, industry profitability, competitive intensity, restructuring charges, and so forth.

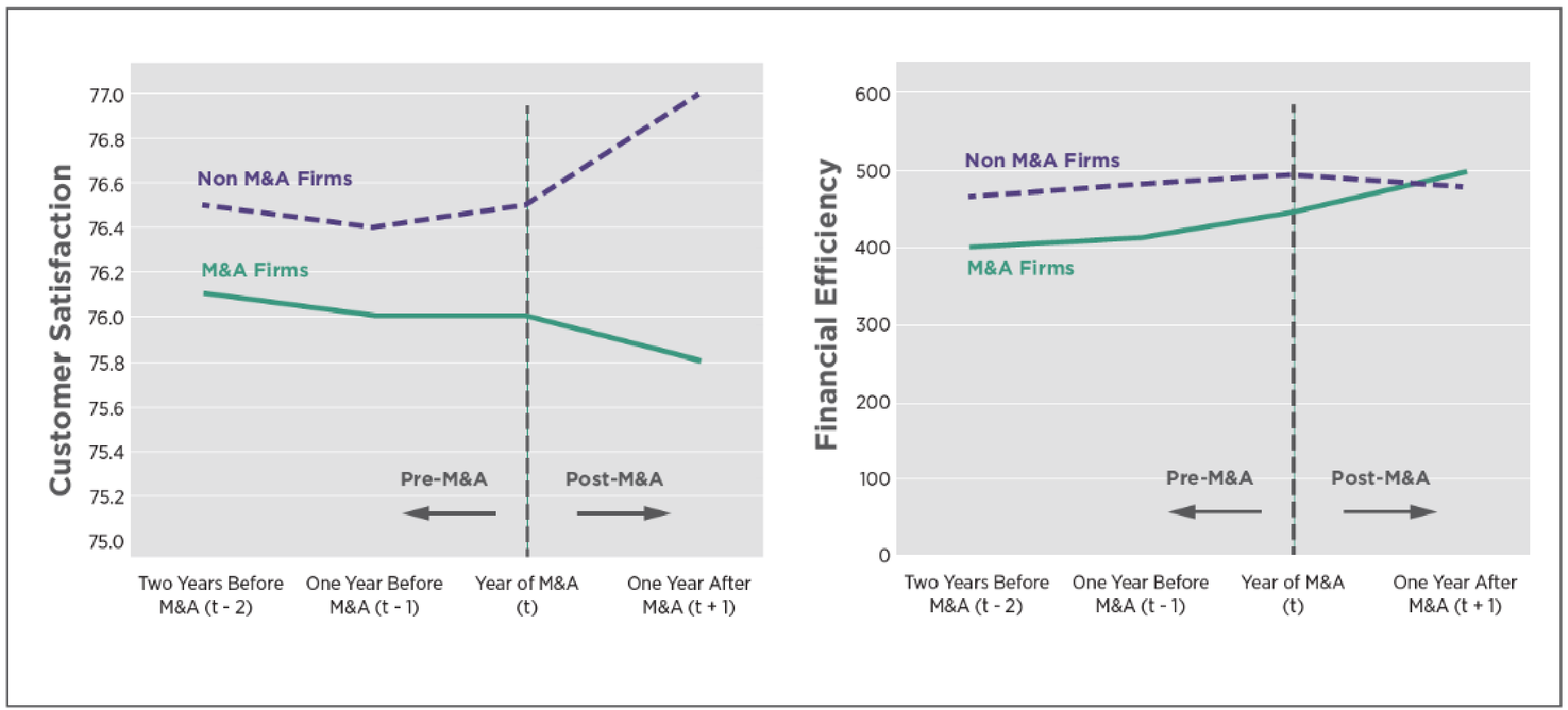

Its main results are shown in Figure 1.

Figure 1: M&A’s Effect on Customer Satisfaction and Financial Efficiency

Source: Umshankar et al, 2022.

The most important takeaways from the study are as follows.

- After an M&A, customer satisfaction unambiguously declines among M&A-firms relative to (1) the pre-M&A period and (2) compared to non-M&A firms.

- In the post-M&A period, firm efficiency increases among M&A-firms.

- The gains from increased efficiency are outpaced by the losses from decreased customer satisfaction.

- The net effect on firm value is negative for M&A-firms.

- M&A-firms’ market value was $481 million less on average than that of non-M&A firms one year after the transaction.

- The decline in market value occurs because executives’ attention at M&A-firms becomes increasingly focused on financial issues at the expense of customer issues. That is, executives become internally focused on efficiencies instead of customer focused; this decreases customer value and sales and leads to a decline in enterprise value.

CONCLUSION: Unless M&A-firms’ senior executives are intentional about customer value, they are unlikely to create shareholder value after the transaction. Intentionality requires measuring customer value, understanding the strategic areas driving it, and ensuring that customer value is the primary driver of the M&A integration process. While it is important to wrest efficiencies, the primary focus of executives at M&A firms should remain on customer value.

References:

- Umashankar, Nita, S. Cem Bahadir, and Sundar Bharadwaj (2022), “Despite efficiencies, mergers and acquisitions reduce firm value by hurting customer satisfaction,” Journal of Marketing, 86(2), 66–86.

- Umashankar, Nita, S. Cem Bahadir, and Sundar Bharadwaj (2022), “Despite efficiencies, mergers and acquisitions reduce firm value by hurting customer satisfaction,” Journal of Marketing, 86(2), 66–86.