Major oilfield services (OFS) companies are under enormous pressure to grow their customer base. Consistent with other B2B companies, they spend 2% to 5% of their gross revenue on sales growth, which includes a combination of lead generation-development-conversion strategies, coupled with brand activities.1

Conversations with OFS executives show the companies’ spending decisions are primarily based on gut feel, intuition, and guesswork. Many OFS companies simply update previous years’ spending on in-person sales, online advertising, tradeshows, and other marketing activities each year.

Following a hunter mentality, some OFS sales and marketing departments focus their growth strategy on new customer acquisition while others follow vendor advice to grow. For example, Salesforce suggests that activities like sales calls and email newsletters are more effective than branding activities like writing white papers, blog posts, and thought leadership articles.2 A noted digital marketing and trade show consulting firm recommends companies focus on industry conferences/expositions and web-based strategies to grow sales.3

Lacking precise data, measurement, and guidance, OFS companies continue spending millions on sales growth strategies that result in wasted resources, slower sales growth, elevated customer acquisition costs, and a low-quality customer base.

OFS companies would benefit from understanding and comparing the relative effectiveness of different sales growth strategies, such as:

• Online advertising versus visits with customers.

• Referrals from existing customers versus online advertising.

• Trade shows versus print media.

• Growing business with existing customers versus sales calls.

Conducted since 2017, the Stratonomics-B2B™ Study is based on data from more than 40,000 customers of over 6,000 B2B companies. It is the largest and most comprehensive study of B2B managers ever conducted.

The OFS study relies on a subset of 2,620 participants. Each participant completes a proprietary assessment of an OFS company on its performance in eight strategic areas and overall customer value. They also provide loyalty metrics, price elasticity, key behaviors, demographics and firmographics.

There are two ways to measure the prevalence of growth strategies among B2B companies.

Asking chief sales, marketing, and executive officers. One approach is to ask B2B company executives which strategies they use, how much they spend on each, and whether they believe each practice is successful.

However, this method is confounded by three strategy inhibitors: salience, intuitive leaps, and egocentrism.4 To CSOs, CMOs, and CEOs, the growth practices of their company will seem relevant (salience), prone to drive success (intuitive leap), and prevalent among other companies (egocentrism).

Asking B2B customers. A better way to capture prevalence is to ask a representative sample of B2B customers about a specific vendor they have used. Next, each customer could check the different growth strategies its vendor used to get their business. The approach can provide a relatively unbiased measure of growth strategy prevalence.

To reliably and simply frame the growth strategy question, the Stratonomics-B2B™ Study directly asks customers how they learned about a vendor instead of asking B2B companies’ executives how they grow their business.

Specifically, each B2B customer is asked:

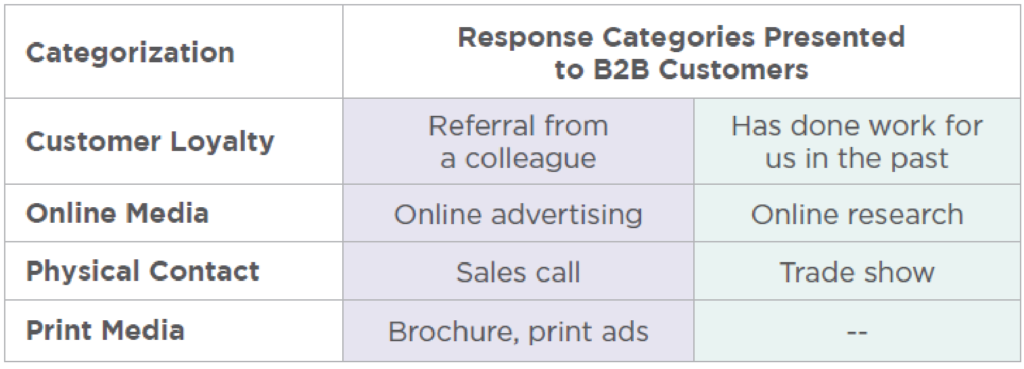

The results in Figure 1 (see the following page) have three important features:

Multiple options chosen. Because B2B customers can choose multiple options, the totals in Figure 1 add up to more than 100%.

Response categorization. To simplify the analysis, the options are grouped in four categories:

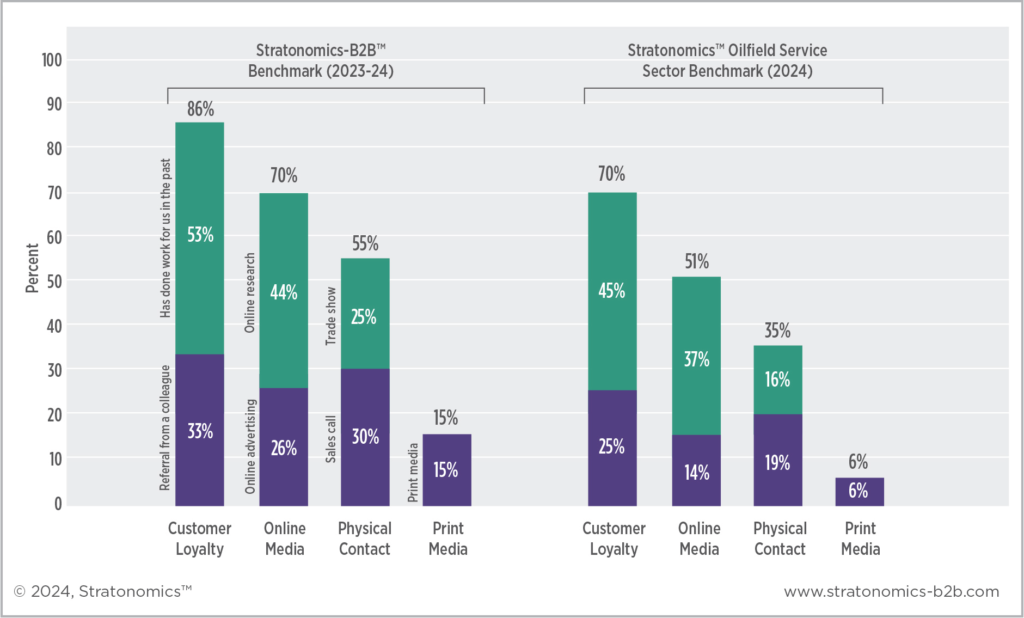

Figure 1 supports several conclusions about the relative effectiveness of OFS sector growth strategies:

1. Customer loyalty is tops. Customer loyalty, as measured by repurchases and referrals, emerges as the top growth strategy for OFS companies: 45% of OFS customers use a supplier that has done work for them in the past, and 25% use an OFS supplier referred to them by a colleague. In other words, 70% of a typical OFS company’s business is based on loyal customers.

Many chief sales and marketing officers in the OFS sector tend to focus exclusively on new customers. It may be equally, if not more, effective to focus on current customers who can help grow sales through referrals and repeat business.

Benchmark comparison: Compared to the full B2B sector, where customer loyalty is responsible for 86% of growth, repurchases and referrals are less important for the OFS sector, where it accounts for 70% growth. One reason is that cultivating loyal customers has not been an overriding goal for OFS companies, with both suppliers and customers displaying opportunistic behavior driven by macroeconomic conditions.

2. Online media is secondary to customer loyalty. Among OFS customers, 51% utilize online media, including online research (37%) and online advertising (14%), to find their current supplier.

Benchmark comparison: Relative to the Stratonomics-B2B™ benchmark cohort, OFS customers are less reliant on online media. Rather than blindly growing online marketing budgets, OFS firms must conduct a judicious analysis to optimize online spending.

3. In-person interactions should be carefully managed. In-person interactions should be cultivated carefully as a sales growth strategy. Specifically, in-person approaches like sales calls (19%) and trade shows (16%) are less critical than other growth strategies.

Benchmark comparison: OFS customers are even less reliant on sales calls and trade shows than other B2B companies.

4. Print media. Print media is a small driver of sales growth, at 6%, likely because most modern print content is digitally available online.

Benchmark comparison: The declining impact of print media is similar among the OFS sector and larger sample of B2B firms.

• Customer loyalty, measured via referrals and repeat business, will continue to be a dominant driver of sales growth for the OFS sector. Underestimating your current customers and chasing new customers is an ineffective strategy for growing sales.

• In terms of investments designed to grow sales, this report shows:

Herzog, Walter, Johannes D. Hattula, and Darren W. Dahl (2021), “Marketers project their personal preferences onto consumers: Overcoming the threat of egocentric decision making,” Journal of Marketing Research, 58(3), 456–475.

Mittal, Vikas, and Shrihari Sridhar (2021), Focus: How to Plan Strategy and Improve

Execution to Achieve Growth, Springer Nature.