The best measure of customer value is customer satisfaction. Customer satisfaction scores measure the extent to which the largest proportion of a company’s customers judge that a product or service has satisfactorily delivered the value they expect based on the company’s value proposition.

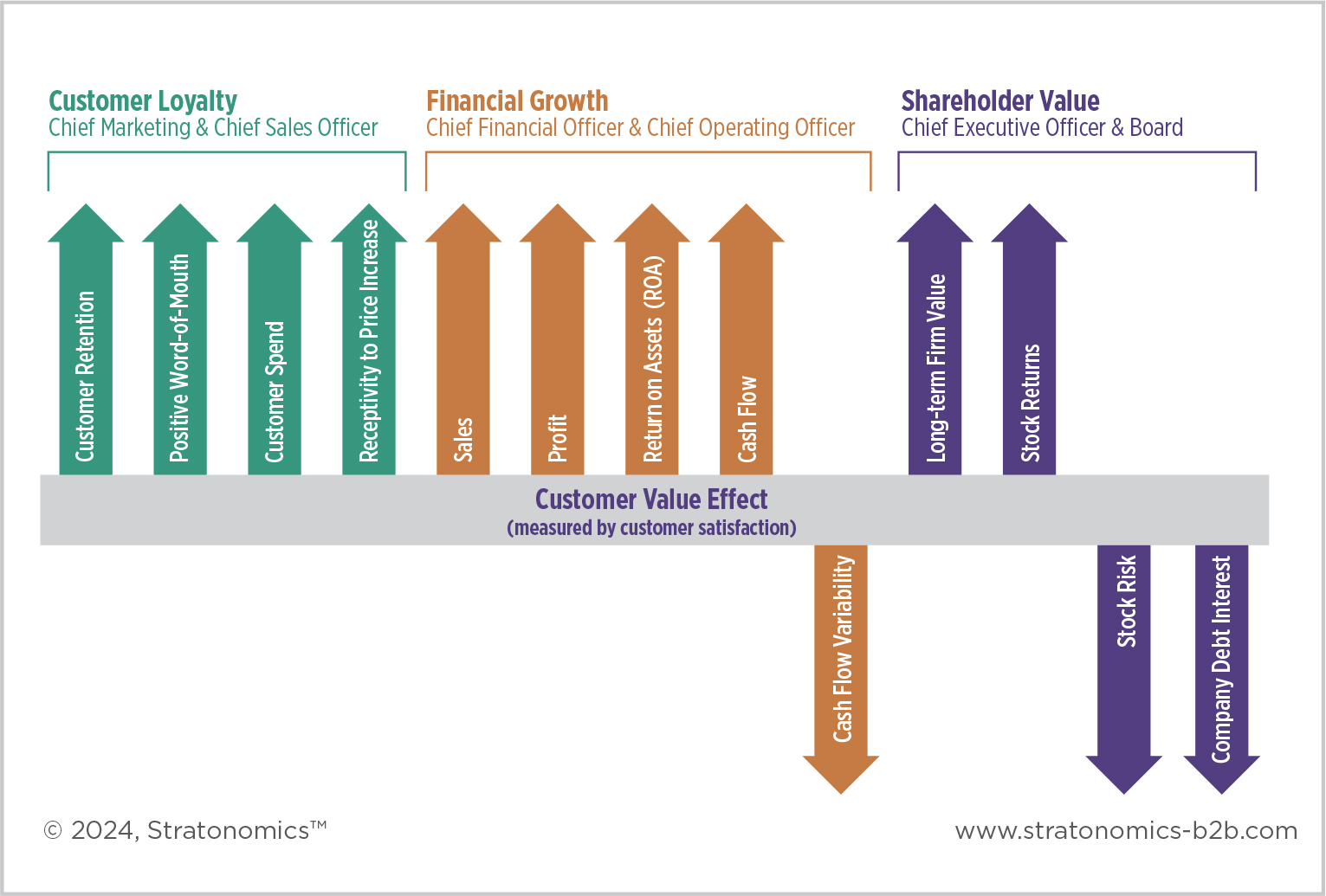

A 2023 meta-study looked at 40 years of research based on 246 articles and 1.15 million data points. As shown in Figure 3, customer satisfaction reliably predicted 13 critical outcomes, including:

- Customer Loyalty. High customer satisfaction is associated with customers who stay with a firm for long periods, engage in positive word of mouth, spend large amounts, and are receptive to price increases.

- Financial Growth. Customer loyalty behaviors help companies increase sales and profits, improve cash flow, and reduce cash-flow variability.

- Shareholder Value. Companies with high revenue, increased cash flow, and reduced cash-flow variability also generate long term shareholder value and increased stock returns. They also have decreased stock risk and cost of debt.

Figure 1: Customer Satisfaction Predicts Financial Outcomes

Senior executives are constantly bombarded to look at alternative metrics to drive shareholder returns. For example, while many CEOs and consultancies swear by Net Promoter, studies have repeatedly shown it does not predict any financial metrics with the Wall Street Journal declaring it a “dubious management fad”. Many consultancies push their clients to excel through branding. Contrary to this belief, an 8-year study of 109 companies showed that customer focused companies had higher margins and gross profit, while brand focus was not associated with either!

CONCLUSION: Customer value is a consistent driver of shareholder value. If properly addressed, it can enable firms to satisfy customers while increasing sales, margins, and enterprise value.

References:

- Mittal, Vikas, Kyuhong Han, Carly Frennea, Markus Blut, Muzeeb Shaik, Narendra Bosukonda, and Shrihari Sridhar (2023), “Customer satisfaction, loyalty behaviors, and firm financial performance: What 40 years of research tells us,” Marketing Letters, 34(2), 171–187. Free download: https://link.springer.com/article/10.1007/s11002-023-09671-w.

- Baehre, Sven, Michele O’Dwyer, Lisa O’Malley, and Nick Lee (2021), “The use of Net Promoter Score (NPS) to predict sales growth: Insights from an empirical investigation,” Journal of the Academy of Marketing Science, 50(1), 67–84.

Keiningham, Timothy L., Bruce Cooil, Tor Wallin Andreassen, and Lerzan Aksoy (2007), “A longitudinal examination of net promoter and firm revenue growth,” Journal of Marketing, 71(3) 39–51.

Morgan, Neil A., and Lopo Leotte Rego (2006), “The value of different customer satisfaction and loyalty metrics in predicting business performance,” Marketing Science, 25(5), 426–439. - Han, Simeng, Werner Reinartz, and Bernd Skiera (2021), “Capturing retailers’ brand and customer focus,” Journal of Retailing, 97(4), 582-596.